Global Valve & Controls

API Q1 Certified | API 6D Certified | ISO 9001 Certified

For more than 20 years, Global Valve & Controls (GVC) has provided engineered valves and flow control packages to the Food and Beverage, Petrochemical, Oil and Gas, Energy/ Power and Agriculture industries. Global Valve & Controls (GVC) continuously strives to design and produce top quality valves and controls offering exceptional reliability, low emissions, easy maintenance and reducing the total cost of ownership.

Global Valve & Controls (GVC) currently produces sizes up to 60” ANSI 150 through ANSI 1500.

API 6D Gate Valves

Global Valve & Controls main objective is to provide the industrial market with valves of the highest quality, performance …

Flanged Ball Valves

ANSI 150 through 600 from Global Valve & Controls high performance flanged ball valve design …

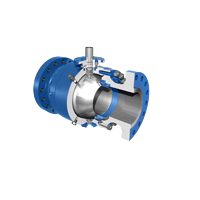

Trunnion Ball Valves

ANSI 150 through ANSI 2500 Global Valve & Controls high performance trunnion ball valves …

Threaded & Socket Weld Valves

GVC offers a complete line of threaded end and socket weld end valves with pressures up to 6000 psi …

Cast Steel Valves

Like the rest of our flow control solutions, GVC offers cast steel valves from ANSI 150 through 2500 …

Forged Steel Valves

GVC offers forged steel valves in Class 800 and 1500 bolted and welded design bonnet …

Valve Automation

GVC offers Electric, Rack and Pinion, and Scotch Yoke Actuators along with limit switches, positioners, regulators …

Valve Flow Control

GVC offers a complete line of valve flow control accessories from brackets and couplers to media containment …

Contact Us

Contact GVC Today …

Our Manufacturing Facility & Operations

API 6D Expanding Gate Valves | Full Port Ball Valves | API 6D Trunnion Valves | API 600 Valves | NACE Valves | API 602 Valves | Spring Return Automation | API 641 Valves

Industries Served

Manufacture Industrial Valves & Controls

Oil & Gas

Food & Beverage

Agriculture

Petrochemical

Pulp & Paper

Energy & Power

Our Products Are Used By Thousands Of Customers

API 6D Expanding Gate Valves | Full Port Ball Valves | API 6D Trunnion Valves | API 600 Valves | NACE Valves | API 602 Valves | Spring Return Automation | API 641 Valves